Dynamic Redistributive Tax

Laura Del Vecchio

© Irina Strelnikova @ stock.adobe.com

The disparity between the rich and poor is more substantial than ever. Additionally, as we are shifting to an economic model based on intangibles, such as cryptocurrencies and Mobile Money, wealth will need to be captured and shared in new ways to ensure fair allocation of taxing rights in an increasingly globalized world.

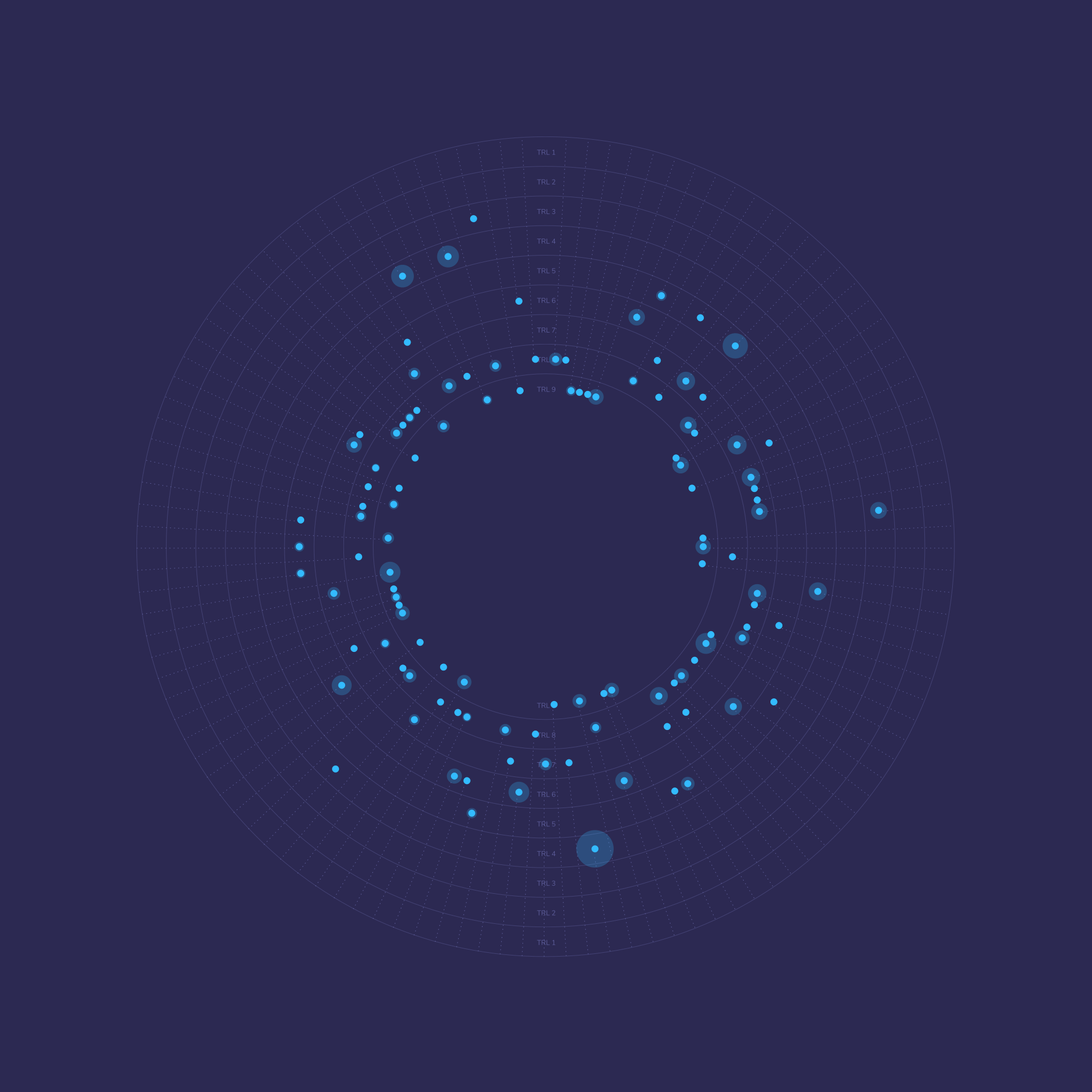

Differently from lump-sum taxation systems, this framework fluctuates taxes according to citizens' financial conditions and opportunities. By combining the assets of Machine Learning Data Analytics with Mobile Crowdsensing Platforms, and applying it into a compulsory contribution to state revenue, this solution provides a mathematical and unbreakable taxation method to narrow the gap between the rich and the poor.

From those at the top of the income scale to those at the bottom, the income obtained from taxation could be totally or partially redistributed to citizens, and reallocation could take different forms. For instance, low-income consumers receive subsidies, and positive taxes are paid by high-income consumers. The tax revenue can be spent on local public goods without affecting household decisions.

Also, it could work as a degressive model, which means that the received amount is inversely proportional to the level of revenue. This mechanism could create new opportunities to involve citizens in new forms of price segmentation aimed at engaging less affluent groups on better welfare consumption opportunities, such as the creation of energy vouchers or any other subsidies tied to taxation revenue.

Redistributive taxation systems must take into account not only the security-net impact of all taxes and subsidies but also current market conditions. Since many vulnerable groups have their incomes based on informal economic activities, such as non-contractual jobs, this solution can potentially accelerate inequality.

Challenges & Opportunities

Even if promising, this solution could directly impact many groups whose incomes are based on informal economic activities, such as non-contractual jobs. It means that the opportunities offered by this business model would not benefit those with the most need, and potentially accelerate inequality by increasing the gap between those who are unbanked or digital illiterate. An optimized taxation system must be accompanied by an elaborated social program, one in which users are empowered to engage in digital platforms and learn how to use them. Also, it is imperative to improve labor standards by forcing companies and employers to regulate their workers accordingly; otherwise, policymakers might be dismissing one vital part of the equation.

In the past years, a new layer has been added to this math; tariffs based on the carbon consumption of a household. This sparked discussions regarding the nature of this model as an unavoidable expenditure that would profoundly impact the most vulnerable households. As a result, activists are fighting for the application of the redistributive mechanism for the decarbonization of processes and incentives, such as Blockchain Carbon Credit. These changes would increase savings and investment, productivity, and economic growth.

System fairness would remain a matter of public debate, something that must be discussed and solved by industries down the road. Finally, inequality is an essential global matter to achieve UN Sustainable Development Goals in the next years. To advance in this path, progressive taxation systems are central to leveling out inequality as a way of support marginalized people and advocate for their rights.

As the world becomes more and more digitized, the debates concerning how to tax the digital economy could lead to a relocation of the taxing rights as an essential platform to the delivery of human rights.