Sovereign Cryptocurrency

Lidia Zuin

Nuthawut @ stock.adobe.com

A Less Speculative Market

Like all resources, money cannot be limitlessly exploited, even in a digital format. On the same note, cryptocurrencies are commonly seen as a way to bring more fairness to the global economic system. Yet, due to their decentralized nature, there is no clear central ownership and stabilization management, thus in past years, their price volatility has jeopardized their potential. Large tech companies are on their way to issuing digital currencies backed by some 'real-world' assets as a collective intent to solve this issue. This movement, however, attracted the attention of private companies aiming to make profit out of this hybrid asset. That was the case of Facebook's cryptocurrency project Libra (to be launched in 2021), as well as China's new digital currency plan for virtual yuan.

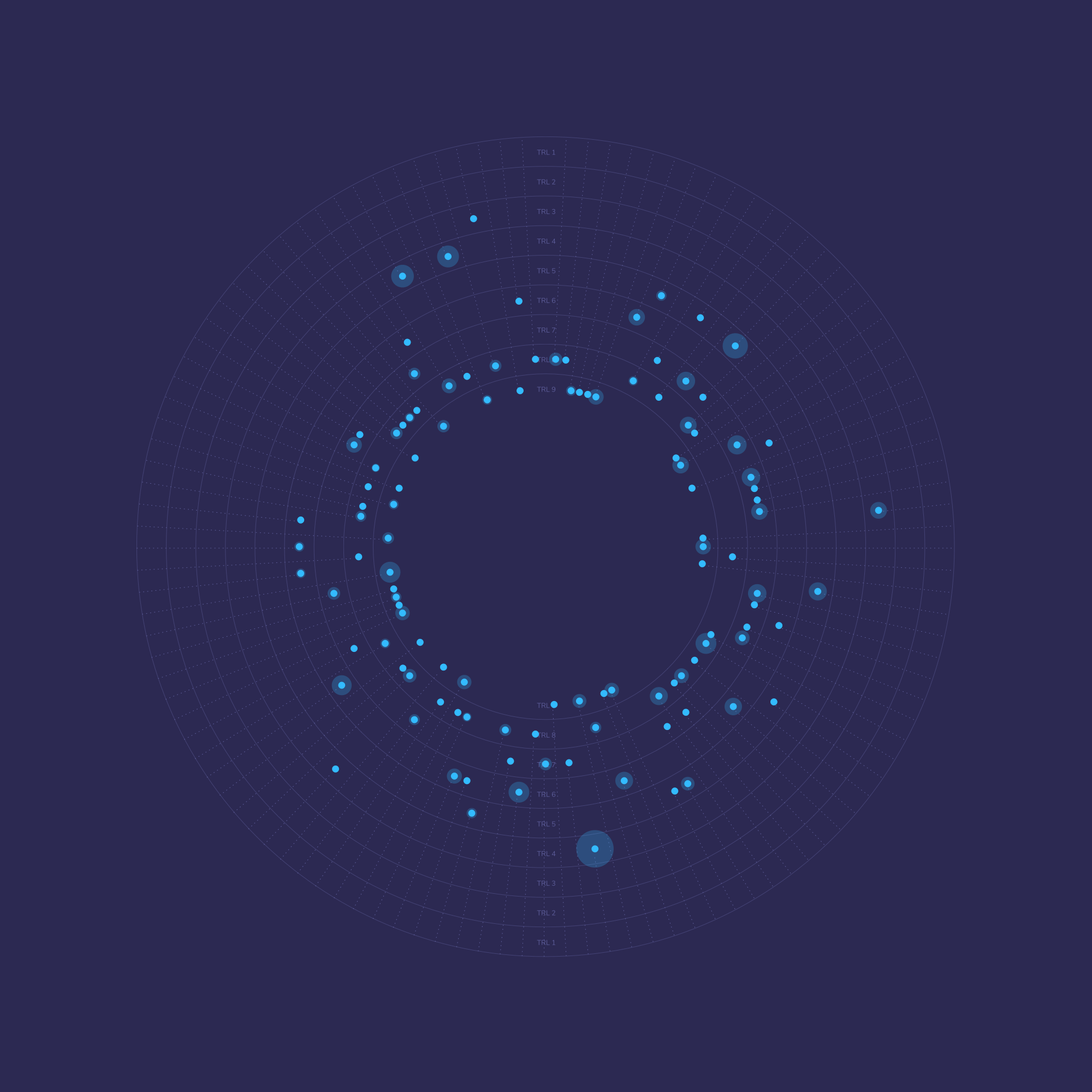

In order to create a more trustworthy and sustainable economic system, governments around the world are trying to partner with private actors to issue hybrid coins with legal tender status when developing these Smart Contracts. Through this model, the more significant the chain, the more its crypto-fiat currency will attract a broader network participation. Besides connecting distant economic systems, the purpose of a Sovereign Cryptocurrency is to promote long-term sustainability and prevent runaway inflation, by algorithmically fixing the annual increase rate on the blockchain. To ensure fairness, each supply grown is automatically sent to all eligible users - not to the banking system as in traditional finance.

Sovereign cryptocurrency rules of issuance are embedded into algorithmically enforced apps (such as the one proposed by the project SOV) and Decentralized Autonomous Organizations (DAO), as well as its own protocol deployed on the blockchain. By legitimizing cryptocurrencies, funds are made available to law enforcement. Additionally, in the third-generation blockchain, the consensus is achieved through less energy usage than in proof-of-work and other similar mechanisms. Furthermore, there is no particular class of nodes required in this protocol, like the miners in the blockchain ecosystem. By providing quick finality, low latency, open participation, with a green, mining-less sustainable environmental impact, sovereign cryptocurrency could also contribute to the UN Sustainability Goals.

Expanding the Concept to IoT

In the next decade, the development of the Internet of Things (IoT) across the globe may require viable economic assets capable of bridging the gap of the digital and physical world. Hybrid models of currency might be vital for transforming a more significant part of the population into autonomous economic actors, all by all connecting the IoT capabilities with individuals with regular civil duties such as tax payments, insurances, and licensing fees.

The digital economy would thus turn into a more automated and self-sufficient model while facilitating the regulation of marginalized markets, and enhancing peer-to-peer transactions through a collaborative regulatory framework. Projects such as IOTA and MXC are taking these topics into consideration when working to provide LPWAN network services to devices around the world, thus enabling the use of cryptocurrencies for digital platforms through IoT devices in a more secure way if compared to current protocols used to connect devices such as smartphones to the internet.